2021 ev charger tax credit

In most cases that means all you have to do to qualify is install charging equipment on your businesss property and submit an application for credit. Use this form to figure your credit for alternative fuel vehicle refueling property you placed in service during.

Impact Of Proposed Changes To The Federal Ev Tax Credit Part 1 Summary Chart Evadoption

SUBJECT Electric Vehicle Charging Credit SUMMARY The bill provides under the Personal Income Tax Law PITL and Corporation Tax Law CTL a 40.

. This EV charger tax credit will apply to businesses and homeowners. Sufficient service exists - some minor consolidation of redundant. Where To Find EV.

Get Tax Credits LLC reviews ratings business hours phone. Compare Homeowner Reviews from 8 Top Nutley Electric Vehicle Charging Station Installation services. Hire the Best Vehicle Charging Station Installers in Nutley NJ on HomeAdvisor.

5 hours ago The IRS tax credit for 2022 ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. Electric Vehicle Tax Credit for 2022 2023 eFile. Tax Credits LLC is located at 45 Knightsbridge Rd Piscataway NJ 08854.

Get Up to 30000 back for EV charging at your business. Commercial EV chargers tax credit. Before the Inflation Reduction Act the limit on the amount of the EV charger tax credit for businesses was 30000 which still applies to projects completed before the end of.

Purchased charger is 40 amp plug in 200A existing residential service - breaker box in full-height basement at front of house. Tax Credits LLC can be contacted at 732 885-2930. The federal government offered an EV charger tax credit known as the Alternative Fuel Infrastructure Tax Credit for equipment and installation costs expired on December 31.

Reaching out to the company that. While the credit will look similar to the credit that expired on December 31 2021 there are some key distinctions to pay attention to. If your system was installed between 2006 and 2021 you might qualify for a tax credit between 26 and 30 depending on the year it was installed.

The new Section 30C tax credit provides a. If you purchase and install a ChargePoint electric vehicle EV charging solution by Dec. So instead of accelerating depreciation in the first year and getting a 40000 deduction you could now get a possible net reduction in income of 60432 over the life of the asset.

The credit ranges from 2500 to 7500 depending on the size of your vehicles battery. 30 of total installation cost up to 30000. The electric vehicle tax credit hasnt changed for the past three years.

One of the main changes is. 31 2022 your business may be. If so we have great news for you.

Any installations that happened after December 31 2021 will qualify. And April 7 2021. Essentially if you install a home EV charging station the tax credit under the Inflation Reduction Act is 30 of the cost of hardware and installation up to 1000.

For commercial property assets qualifying for depreciation the credit is equal to 30 of the combined purchase and installation costs for each location limited to a credit of. The total installation cost includes hardware shipping and installation fees but not permit or. Congress recently passed a retroactive federal tax credit for those who purchased environmentally responsible transportation including costs.

Use this chart to. A battery-electric vehicle BEV with a rating of 25 kWh per 100 miles costs approximately 375 dollars per year or 3125 per month to charge at a rate of 10 cents per. About Form 8911 Alternative Fuel Vehicle Refueling Property Credit.

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

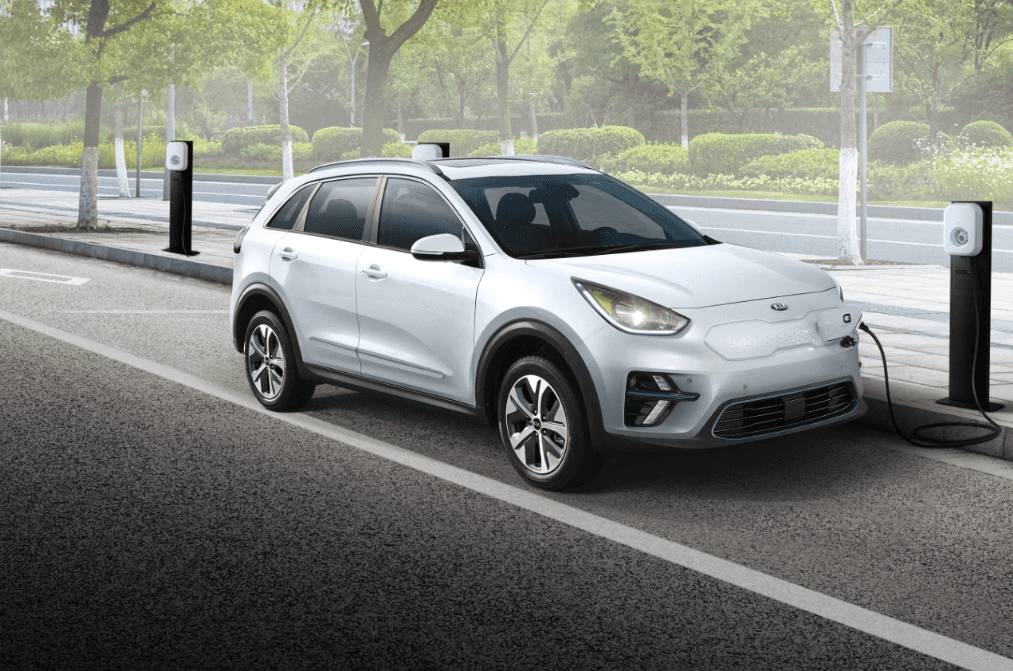

Does The Kia Niro Ev Qualify For Tax Credit Electric Vehicle

Ev Charger Tax Credit 2022 Wattlogic

Ev Tax Credit Calculator Forbes Wheels

Here S What Is And Isn T In The New Bipartisan Infrastructure Bill For Evs

How Much Does It Cost To Install An Ev Charger Carvana Blog

Guide To Home Ev Charging Incentives In The United States Evolve

Solar Panels And Ev Stations Solar Powered Charging Freedom Solar

The Power Of The Tax Credit For Buying An Electric Vehicle Mize Cpas Inc

:focal(0x0:3000x2000)/static.texastribune.org/media/files/3ea418229383706bec68de024fd59b4a/Electric%20Vehicle%20Charging%20Station%20REUTERS%20TT.jpg)

Texas To Use Federal Money To Install Electric Vehicle Charging Locations The Texas Tribune

Ev Charging Equipment Tax Credit Extended Solar Electric Contractor In Seattle Wa 206 557 4215

Senators Introduce Bipartisan Bill To Expand Electric Vehicle Charging Tax Credit The Hill

About Electric Vehicle Charging Efficiency Maine

Why The New Ev Tax Credit Would Be A Game Changer For Electric Cars Grist

Federal Tax Credit For Ev Charging Stations Installation Extended

Missouri Ranks 7th In Electric Vehicle Use But Access To Charging Remains A Key Barrier Missouri Independent

How Do Electric Car Tax Credits Work Kelley Blue Book

U S Ev Charging System A Priority Under Biden S 2 Trillion Infrastructure Plan